If you’ve ever started a new job, you’re familiar with the process of completing your W-4 form.

That’s the IRS document your employer requires you to complete so they can determine the proper amount of income tax to withhold from your pay. Get it right, and you might get a nice refund at tax time. But get it wrong, and you may end up owing tax – plus penalties and interest.

How to fill out a Form W-4 is more important than ever. And even if you’ve completed the form in the past, you may need some help because it’s a little different now.

For example, in previous years the form was used primarily to calculate allowances. Each allowance was a flat amount, and you could adjust your withholding – higher or lower – by changing the number of allowances you were claiming.

Part of this was also because there was an exemption for dependents. But with the Tax Cuts and Jobs Act of 2017, there have been major changes in the tax code, including the elimination of claiming dependents.

That’s a major reason for the near-complete change in Form W-4. Now the form requires you to make various estimates of your income and tax situation, which is a bit more complicated than simply determining a specific number of allowances.

But not to worry, in this guide, we’ll show you how to fill out a Form W-4 for 2021.

Table of Contents

🔄️ Updated with 2024 information: It was not a big change from the previous years (since 2020). The only change was to the Step 4(b) Deductions Worksheet because the amounts of the standard deduction increases each year.

Form W-4 Basics: 2024 Edition

A new employer should provide you with a blank Form W-4 to complete when you start a new job. But there may also be times when you’ll want to adjust your withholding even on a job you already have. It might be necessary if you get married or have a child, since either has the potential to change your tax liability.

You should request a copy of the form from your employer (usually either the human resources department or payroll). And if all else fails, you can always get a copy that’s printable from the IRS website, complete with instructions.

Once you’ve completed the form, submit it to your employer. They’re not required to file it with the IRS, but they should maintain a copy for their records, as well as to make necessary changes in your payroll withholding. In fact, your employer is required to make the requested changes to your withholding within 30 days of receipt of the completed form from you.

It accurately completed, the W-4 should result in either a very small amount owed when you file your income tax return or an equally small refund.

A small refund isn’t bad. When you get a large tax refund, it’s because you’ve over withheld taxes. It’s not a gift from the government, they’re just giving you back your money. If you get a large refund, you’ve given the IRS an interest-free loan. In the tax-preparation universe, the smaller the refund, the better the tax planning!

That said, it’s not horrible to get a large tax refund either. It’s “forced savings” in a sense and for some, that’s a good thing. Either way, you should do what’s right for you and filling out the Form W-4 properly is the first step.

Let’s get into how to fill out a Form W-4.

Filling Out a Form W-4

Though it’s hard to see when looking at the form, the basic process of completing a W-4 is actually pretty simple. But if you’ve ever relied on an instruction booklet to put an unassembled item together, you already appreciate that the process can seem more complicated than it actually is.

That’s certainly true with the W-4. If you’re using this guide to help you prepare the form, we recommend printing off a copy of the W-4 itself you can follow along, and even fill in the information as we move forward.

Below is a screenshot of the first page of the form that you’ll need to follow along (it says 2021 in the upper right for the screenshot but this part of the form hasn’t changed for 2024).

You can begin by completing the general information requested in Step 1, Lines (a) through (c). That will include your first name and middle initial, last name, Social Security number, complete home address, and your tax filing status.

Step 2: Multiple Jobs or Spouse Works

Step 2 is where things start to get a bit complicated. You’ll need to complete this section only if you have more than one job or if your spouse is also employed and you file jointly. If these don’t apply, you can skip it completely.

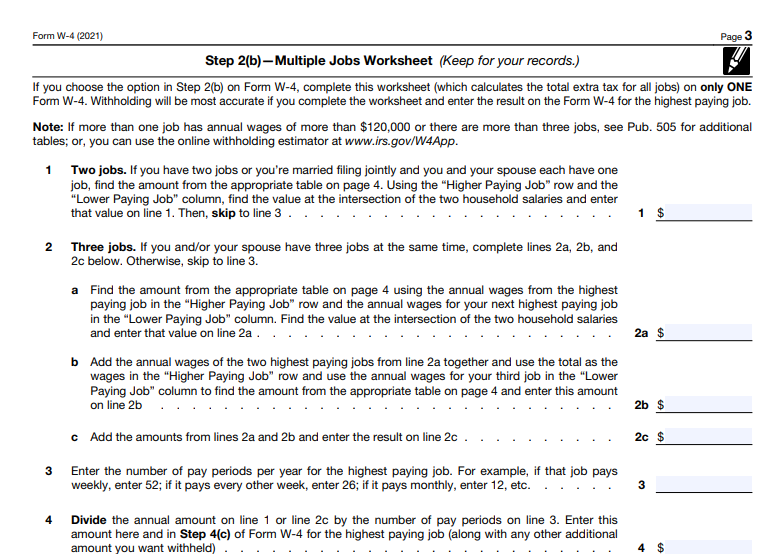

But if it does describe your income information, you’ll need to move down to Page 3, then complete Step 2(b) – Multiple Jobs Worksheet.

But this is where we need to take a little break, to make an important point. Completing this section only refers to this particular W-4. You’ll still need to complete a separate W-4 for each additional job you or your spouse hold. And yes, you’ll need to complete similar information on each W-4.

But for now, let’s focus on the W-4 at hand. (again, it says 2021 in the upper left but the 2024 version is identical for this portion)

But since having a second job or a spouse who also has a job are hardly uncommon situations, let’s proceed with the assumption that one or the other will be required for this W-4.

Starting with Step 2(b), Line 1, let’s assume your spouse is also employed and you are married filing jointly.

But before we complete that first line, we’re first going to need to jump down to the income schedule on Page 4 (I told you this would be more complicated than in the past!)

You’ll need to get the entry for Line 1 from this schedule.

Let’s assume you earn $90,000 and your spouse earns $60,000 per year, for a combined income of $150,000.

Start by going down the left side of the table and identifying your own income range, which will be $80,000-$99,999. From there, go across to the column indicating an income between $60,000 and $69,999. This column will represent your spouse’s income.

Where the two intersect, you’ll see the number $9,420. You’ll enter that amount on Line 1 of Step 2(b). Unless either you or your spouse have a second job, you can skip Line 2.

Moving down to Line 3, enter the number of pay periods for the year for the highest paying job, which is yours. As is typically the case with most jobs, we’ll assume you’re paid every other week, for 26 pay periods per year.

On Line 4 you’ll be instructed to divide the amount on line one – $9,420 – by the number on Line 1 – 26 pay periods. That amount will be $362. You’ll enter the amount on Line 4 of this schedule, then also on Page 1, Line 4(c) – Extra Withholding.

Once you’ve done that, we can move back to Page 1 to complete the rest of the form.

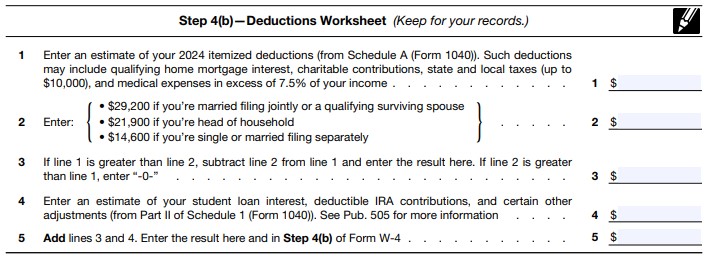

This next part is the Deductions Worksheet for if you want to get more granular and don’t intend to claim the standard deduction. You can use it but it’s optional.

Step 3: Claim Dependents

You’ll only need to complete this section if you have dependents you can claim. Now this is not for the purpose of claiming personal exemptions for those dependents, but rather for claiming the child tax credit, which will reduce your tax liability by up to $2,000 per dependent. However, you can only claim this credit if your dependents are under age 17 by the end of the tax year, and you earn no more than $200,000 as a single file or $400,000 if you are married filing jointly.

If you do qualify for the child tax credit, this part of the form is pretty simple. You can just take the number of eligible dependents and multiply it by $2,000. So, if you have two dependents, you’ll be eligible for a total credit of $4,000. You can enter that amount on Page 1, Line 3.

Step 4: (optional) Other Adjustments

You’ll use this section as a catchall for any other situations you have that may affect your withholding. The instructions under Step 4 outline when completing this section will apply. You’ll use this section to enter information that may either increase or decrease your withholding, based on less typical tax circumstances.

Those include the following:

- a. Other income (not from jobs). This is the line you can use to increase your withholding for other income situations that may not have provided for tax withholding. This can include investment income, pensions, or even self-employment. You’ll enter the total amount of other income on this line (not the tax liability you expect to have).

- b. Deductions. This line will mostly be for itemize deductions. But those will only be the amount of itemized deductions that exceed the standard deduction. You can go to the section labeled Step 4(b) to calculate these additional deductions (below). This is also where you’ll enter “above the line” deductions, like student loan interest and deductible contributions to retirement plans like IRAs.

- c. Extra withholding. If you want to have extra withholding for any purpose, such as for the expected sale of a major asset that will produce a tax liability, you can enter the estimated tax amount here.

For the purposes of this section let’s assume both you and your spouse each take a $6,000 deduction for tax-deductible IRA contributions. You’ll enter $12,000 on Step 4(b), Line 1, as well as on Line 5. Then transfer the same amount to Page 1, Step 4(b) of Form W-4 itself.

Completing Form W4

Because of the adjustments we discussed above, W-4 Page 1 will reflect the following information:

- $4,000 for the child tax credit for two children on Line 3

- $12,000 in IRA contributions on Line 4(b)

- Extra withholding of $362 on Line 4( c)

Then finally in Step 5, you’ll sign and date your W-4 form, certifying that the information you submitted is correct. But once again, this form is not filed with the IRS, but only used and retained by your employer to determine the proper amount of withholding you need.

Final Thoughts

Once you’ve done one or two, you’ll realize it’s actually pretty simple. But until you reach that point, you should complete the form only with line-by-line instructions. If you’re at all confused by the form, you can ask for assistance from your human resources or payroll department. But more likely, they’ll refer you to your own personal tax advisor.

That step is well advised because a mistake in completing the form can result in either a large tax bill when you file your return, or the loss of net income out of your paycheck in favor of an outsized refund after filing. Properly completing Form W-4 will help you avoid either outcome.

Elie says

hi Kevin,

In the Two-Earners/Multiple Jobs Worksheet, on line 3, it says: note: If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. does that mean i should i go back to w4 page and enter zero instead of what i had before as allowances, which resulted from number of dependents? in other words, when i started with the w4 from top, i calculated the number of allowances as 6, so when i get to this line i’m asking here about, do i remove the 6 and replace it with 0 ?

thank you, this has been confusing me so much.

Justin says

I would also like to know the answer to this