They say that you feel invincible when you’re young. When I was in my twenties, I didn’t feel invincible. I just never considered seemingly random medical problems that would happen to me. None of my friends experienced them.

Then, around the age of 30, several of them tore ACLs or their Achilles. Some did it in sports, some did it doing stupid things (jumping over garbage cans), and some did it doing completely mundane things like sitting down in their car.

Then, in my thirties, more serious medical events happened. Friends battled cancer. Most beat it but after month-long battles where working was an afterthought.

At FinCon2019, Sharon Epperson gave a closing keynote about adversity. Professionally, Sharon Epperson is CNBC’s Senior Personal Finance Correspondent but her story of adversity comes from something that happened in her private life – she survived a brain aneurysm.

And the deluge of medical bills and paperwork.

And endured the long and arduous recovery process you’d expect from a brain injury.

When she was on stage, giving her talk, you would have had no idea what she went through… but her story of how it can strike anyone hit home.

~6.7 million Americans (1 in 50) may have an aneurysm and not know it, according to the Brain Aneurysm Foundation. Don’t read the stats unless you want to ruin the rest of your day… suffice it to say, it’s not as uncommon as you think.

There are very few things you can do to prevent some of these medical issues… but there are things that can help you navigate them. One of them is disability insurance.

Until I researched for this post, I knew very little about disability insurance. All I knew was that my previous employer offered it. There’s a whole infrastructure for disability, including federal and state government support, but it’s limited in its protection. If you’ve wanted to learn more about disability insurance, I hope this article helps.

Table of Contents

🔃 This post was written in September of 2019 and updated November 2023 with new links to updated statistics and adding Puerto Rico to the list of “states” that offer disability insurance (though it’s a territory).

What is Disability Insurance?

Disability insurance covers you if something happens and you’re unable to work and continue to earn an income at the levels you previously earned. Sometimes this means full disability, where you can’t work at all, and sometimes this means partial disability, where you can work but unable to earn the same amount as before.

The classic case is that of a heart attack. If it didn’t happen as a result of your job, you wouldn’t be covered by workers comp. And since you still have your job, you wouldn’t be covered by unemployment or other government benefits. Your employer will often have coverage in the case of short term disability but that’s a small percentage of your salary (40-60%) for a short period (30 days to 6 months, depending on your state).

What happens if you need longer to recover? That’s when you would fall under long-term disability insurance. Many large employers will offer a group long-term disability insurance that is paid for entirely by the company. When you get the benefits, you owe federal and state income tax on the benefits unless your employer also pays that. No law requires an employer to offer long term disability coverage. Again, the coverage is about 60% of your salary and it starts after your short term ends.

There are four types of disability insurance – short term disability, long term disability, Social Security disability, and worker’s compensation.

Short term disability

Short term disability will usually be through your employer and covers temporary “short term” problems. There aren’t too many companies offering this and most employers offer this for free. The benefits are usually 60-80% of your income and last only 3-6 months.

Long term disability

Long-term disability is what most people think of when you think “disability” insurance. Once your short term disability ends, long term kicks in. Benefits are usually between 60-80% of your pre-disability income but the term can last years. Some policies are written to pay out until you reach a certain age (such as 65). And some policies will also cover you if you are able to work but must take a job that pays less.

Related: 7 “Weird” Types of Insurance You Didn’t Know You Needed

Social Security disability

Social Security disability insurance (SSDI) is meant for those who suffer a disability that is expected to last at least a year or result in death. If you look in your paycheck, you will see deductions for Social Security and those are, in part, effectively your premium payments into the SSDI program.

There are two disability programs – the SSDI and the Supplemental Security Income (SSI) program. I won’t go into them in detail, it can get very complicated, but if you paid enough into the program and qualify as disabled, you will be paid monthly benefits.

If you file a claim and are denied, it’s possible that you can get legal help from a company like Atticus for your disability claim. There are a lot of lawyers who specialize in this, so if not Atticus, reach out to someone local.

Workers compensation

I wanted to include this in the list of different types of disability insurance because it’s what will cover you in the event you are disabled on the job. Employers pay for workers’ compensation and it’s available to employees should they get hurt on the job.

How Does Disability Insurance Work?

Disability insurance is like many other insurances. The key parts of the policy are:

- Your monthly premium payments to the policy

- What the policy considers a disability – this can vary from policy to policy. Some policies say that you must be unable to work any job to qualify for payments. Others say that if your disability reduces your income, you qualify for benefits.

- How much you are paid if you are disabled – the benefits. This is often calculated as a percentage of your income, usually 60-80% of what you earned.

- How long your benefits will be paid – the benefit period can vary and be anywhere from months to years. Instead of years, they may specify payouts up to a certain age.

As we will discuss in further detail below, there are a bunch of riders you can add to a disability policy. What I’ve listed above is just the core policy itself. You pay premiums, you get payments if you are disabled, and you keep that protection as long as you make payments.

State Offered Disability Insurance

5 states offer State Disability Insurance (TDI) or Temporary Disability Insurance (TDI). Those states are California, Hawaii, New York, New Jersey, and Rhode Island – plus Puerto Rico.

In each of those, the coverage varies:

- California – covers 52 weeks for disability, 6 weeks for paid family leave

- Hawaii – covers 26 weeks for disability

- New Jersey – covers 26 weeks for disability, 42 days for family leave

- New York – covers 26 weeks for disability

- Rhode Island – covers 26 weeks for disability

- Puerto Rico – covers 26 weeks for disability

The amount and the eligibility requirements vary from state to state as well. For example, in California, you are eligible for this insurance if you are unable to work for at least 8 days. You must be under the care of a licensed physician or medical practitioner, who must also certify to the disability. You may even have to take an independent medical exam. If all that is true, you must also have earned at least $300 and had deductions taken out of your paycheck.

In Rhode Island, you are eligible if you are unable to work for seven consecutive days. Claims last for a maximum of four weeks but you can renew after another 7 day waiting period (when you are unable to work). Again, you must be under the care of a medical professional and the earnings requirement is higher – $11,520 in the last four or five quarters.

If you want more information, I suggest reviewing each state’s respective website:

- California State Disability Insurance

- Hawaii Disability Compensation Division

- New Jersey Division of Temporary Disability and Family Leave Insurance

- New York Disability and Health

- Rhode Island Temporary Disability

- Puerto Rico Disability

Private Disability Insurance

If you can get employer disability insurance, why bother with private disability insurance? With an employer’s disability insurance, you’re only covered for as long as you are employed. You can also lose that disability insurance if the insurer (or employer) decides to not renew the plan. What’s nice about a group policy is that everyone in the group is covered, so you are automatically included if you opt-in.

With an individual policy, you keep it until you decide you don’t want it (and stop paying). This means you can quit your job and not be concerned about disability insurance. The premium you pay is also locked and cannot change.

Isn’t this what an emergency fund is for? Yes and no. You can think of an emergency fund as a self-funded disability insurance policy. But the issue with a disability, temporary or permanent, is that it completely changes your life. It’s not like “just” losing your job, where you are physically fine and able to work, because it impacts the way you live. It’s hard to fund that with 6-12 months of expenses and still be able to deal with the day to day.

You can have minor disabilities, like broken bones, or you can have more serious ones, like a stroke, that take much longer to recover. A car mechanic with a broken hand can’t work for a few weeks. A car mechanic that’s had a stroke may not work ever again.

What About Freelancers & Self-Employed?

As a self-employed person, I don’t have disability insurance through my employer. We have a small amount of insurance through my wife’s employer, but is that enough in the event of a disability? Probably not.

The question is whether it’s worth it to pay for private disability insurance. With private insurance, you’re essentially paying for a policy that pays you in the event you can’t work. When you pick a policy, it will explain how much they pay if you can’t work and the rules for claiming those benefits. If you want a policy with a higher benefit, you pay more.

So, step one is to figure out how much disability insurance costs.

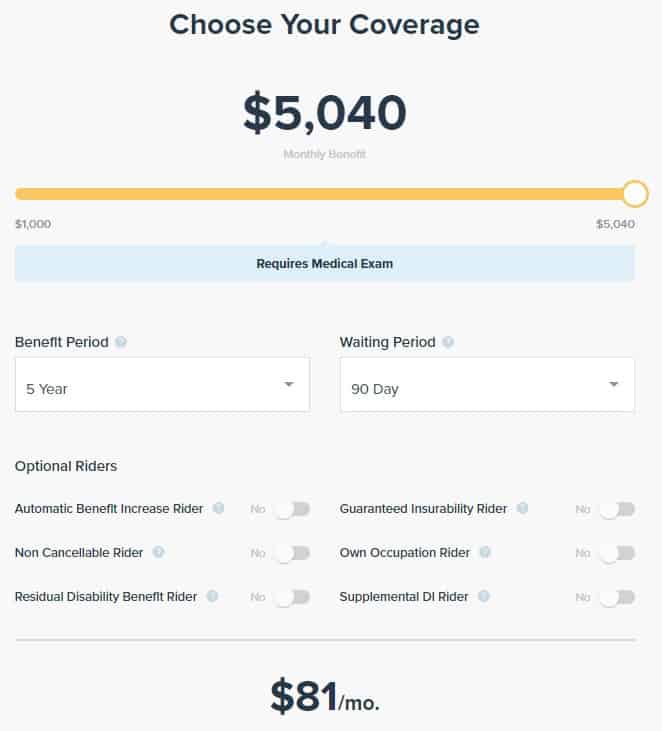

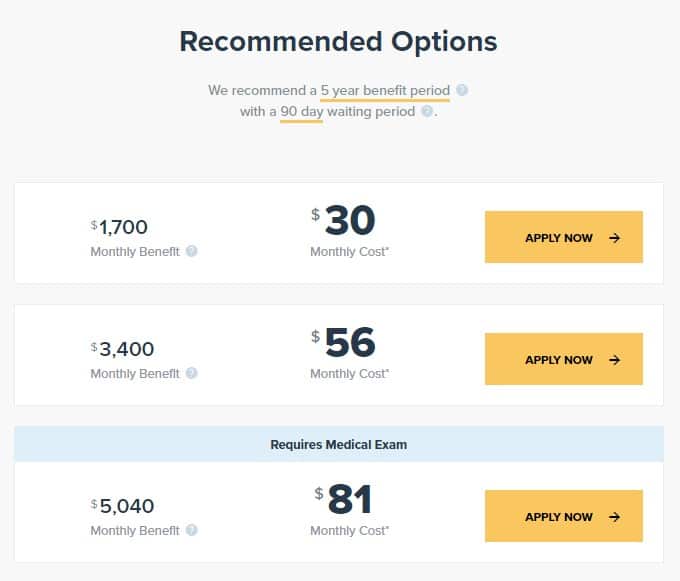

I went on Breeze to get a quote for disability insurance and after just a few short questions (I used a hypothetical situation with $100,000 in earnings for a 39 year old non-smoker, a custom situation), I was shown this:

The cost of disability insurance is based on many factors including these:

- Your Age: Older people pay more than younger people

- Your Job: Different types of occupations pay different prices. Professional occupations (like desk jobs) typically receive better rates than more manual jobs (like heavy labor) due to the differences in risk.

- Benefit amount: The more coverage you want, the more expensive the policy is.

- Gender: Females pay higher rates than males. This is the opposite of life insurance, where males pay higher rates than females.

- If You Use Tobacco: Like life insurance, tobacco users will pay higher rates.

- Riders: Any “extras” you add to your policy can increase the price (more on this below).

Two clarifying notes:

- Benefit Period: This refers to how long the insurance company will pay monthly benefits – so five years means the policy will only pay out 60 months of benefits, partial or total disability.

- Waiting Period: This refers to how long you must be disabled before you start getting benefits – so 90 days means if I am disabled today, I am eligible for benefits in 90 days.

- Medical Exam: A medical exam is only required for a monthly benefit over $4,000. That’s why the last row requires a medical exam but the first two don’t.

I was able to tweak the coverage on another screen and it shows you the “pricing” live. I put pricing in quotes because these are just estimates, you still have to apply and take a medical exam, before you get issued a policy.

Here are a few optional riders you can include:

- Automatic Benefit Increase Rider – After a year of continuous payments, the rider increases the base monthly benefit by 5% until the payment hits 2x the original (this is meant to account for inflation)

- Non-Cancellable Rider – Policy and riders can’t be canceled by the insurance company (they can’t increase premiums either).

- Residual Disability Benefit Rider – If you are residually disabled and the elimination period has been satisfied by any continuous period of total and/or residual disability, this rider pays the residual disability benefit rider.

- Guaranteed Insurability Rider – This rider lets you increase the base policy monthly benefit by buying more insurance.

- Own Occupation Rider – Extends the own occupation period for total disability definition from two years to the period you choose

- Supplemental DI Rider – This pays a monthly benefit less any social insurance benefits received, offset dollar for dollar, if you are totally disabled and the elimination period has been satisfied.

You can also play with the benefit period and waiting period. I was surprised to see the quote jump from $81/mo to $177/mo when I lowered the waiting period to 30 days. This does make sense because now you include all those short term injuries, like a broken bone, that could fully heal within 90 days. Increasing the benefit period to age 65 only upped the premium to $123 a month.

This calls for more research but now I have a starting point.

Do you have disability insurance?

A Journey to FI says

Jim, this is a very timely post. I work full time and benefit election period opens up in November. We are a one-household income and have never elected long-term disability; however, I’ve been thinking a lot about it. In general, my thought has been … I’m young and healthy so we should be fine. However, the risk of not having it could be high. I’ll take a look at the policy this year and will report back. Thanks for this post.