Are you looking to open a new brokerage account to manage your portfolio of investments but aren’t sure which one?

Many online investment platforms compete for business by offering new account promotions based on the assets you can transfer to their platform. While promotions shouldn’t be the only consideration, these promotion/bonus amounts are too hard to look past.

There are a range of bonuses listed below, whether you have an established portfolio and looking to transfer stocks, or starting new account – there are ways to add more money to your balance by taking advantage of these bonuses.

Continue reading to review the best brokerage account promotions for new accounts.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

🏆 Our Top Picks:

- Tastytrade [Best Bonus] – Tastytrade is our Editor’s Pick as the best brokerage promotion because it offers up to $5,000 when you deposit a large amount – it’s the highest bonus amount as a ratio of the deposit.

- Yieldstreet [Best Bonus to Cash Ratio] – Yieldstreet is an investment platform that will give you $500 when you deposit $10,000 – easily the best ratio on this list.

- Moomoo [Best for Free Stocks] – Moomoo has a simple promotion that everyone should do it – open an account and you get 15 Free Stocks. It’s tiered so you get more stock as you deposit more money – it’s super easy.

Table of Contents

- 💸 Tastytrade – up to $5,000

- Streetbeat – up to $14,000

- J.P Morgan Self-Directed Investing – up to $700

- 💲Moomoo – 15 Free Stocks

- 💲Webull – up to 12 free stocks

- Yieldstreet – up to $500

- Firstrade – up to $5,000

- 💲Robinhood – free stock (valued $5 - $200)

- M1 Finance – up to $20,000 [EXPIRED]

- TradeStation – up to $3,500

- Acorns – $20

- Public – up to $30,150

- Tornado – up to $1,000

- E*TRADE – up to $1,000

- SoFi Invest – $25

- U.S. Bank Automated Investor – $100

- Citi Personal Wealth Management – up to $5,000

- Merrill Edge – up to $600

- Charles Schwab – Multiple Bonuses

- Charles Schwab $101 Starter Kit

- Charles Schwab Investor Reward – Up to $2,500

- Charles Schwab Refer a Friend – Up to $1,000

- Fidelity Account – $100 Cash

- Frequently Asked Questions

💸 Tastytrade – up to $5,000

Tastytrade has a new account promotion – open and fund a new Tastytrade account and transfer in funds to get up to $5,000 in cash. This is a great offer if you are looking to open a Tastytrade account and an increase from their previous offer.

This is valid for new Tastytrade customers and existing Tastytrade customers as long as they have not yet funded an account.

The bonus is based on the amount transferred:

| Deposit Amount | Cash Bonus |

|---|---|

| $2,000 – $4,999 | $50 |

| $5,000 – $24,999 | $100 |

| $25,000 – $99,999 | $500 |

| $100,000 – $249,999 | $2,000 |

| $250,000 – $499,999 | $3,000 |

| $500,000 – $999,999 | $4,000 |

| $1,000,000 – $4,999,999 | $5,000 |

The referral/promotion code for this offer is “MYNEWBONUS” and you must put it in the Referral Code Field when applying.

Here’s our full review of Tastytrade.

Learn more about Tastytrade

(Offer expires 12/31/24)

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.

Streetbeat – up to $14,000

Streetbeat is an AI-powered financial “advisor” that will suggest investment portfolios based on what you would like to invest in. They have a series of portfolios that they’ve already created like “U.S. Congress Buys” and “Tog Gov Contract Recipients.” It really changes how you think about a portfolio.

We have a review of Streetbeat if this approach is interesting to you.

They have a bonus offer though and it’s two-fold.

First, anyone who signs up and enters the bonus code WALLETHACKS will get a bonus of anywhere from $10 - %5,000. It’s awarded immediately but you can’t withdraw it for three months. You can invest it or just keep it as cash and wait.

Next, they have a deposit bonus based on how much you deposit:

| Deposit Amount | Bonus Amount |

|---|---|

| $500 – $999.99 | $20 |

| $1,000 – $9,999.99 | $50 |

| $10,000 – $49,999.99 | $100 |

| $50,000 – $99,999.99 | $250 |

| $100,000 – $499,999.99 | $1,250 |

| $500,000 – $999,999.99 | $4,000 |

| $1,000,000 – $4,999,999.99 | $8,000 |

| $5,000,000+ | $14,000 |

J.P Morgan Self-Directed Investing – up to $700

J.P. Morgan Self-Directed Investing has a bonus offer based on how much you deposit into a new account within 45 days. The account snapshot is determined on day 45 and then you just need to maintain those funds until 90 days from enrollment. The bonus is deposited 15 days after you qualify.

If you can meet the amounts, it’s a decent offer with a relatively low cap (compared to others). This works for a general investment account as well as a Traditional IRA and Roth IRA.

The tiers are:

| Deposit Amount | Bonus Amount |

|---|---|

| $5,000 – $24,999 | $50 |

| $25,000 to $99,999 | $150 |

| $100,000 to $249,999 | $325 |

| $250,000 or more | $700 |

The account also offers commission-free trades of stock, ETF, and option trades as well as a suite of tools you can use to make smarter investing decisions.

Here’s our full review of J.P. Morgan Self-Directed Investing.

Get your bonus from J.P. Morgan

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT – NOT FDIC INSURED – NO BANK GUARANTEE – MAY LOSE VALUE

💲Moomoo – 15 Free Stocks

Moomoo is a commission-free brokerage app just like Webull and Robinhood. Its parent company Moomoo Financial Inc. is a subsidiary of Nasdaq-listed FinTech FUTU and is regulated by the U.S. Securities and Exchange Commission and FINRA, which means your account is protected by the Securities Investor Protection Corporation (SIPC) with insurance up to $500,000.

Moomoo is offering you free shares of stock when you open and fund an account:

| Total Net Deposit | Total Stocks You’ll Get | Eligibility |

|---|---|---|

| $100 – $999.99 | 5 free stocks | New client |

| $1,000 or more | 15 free stocks | New client |

There are no trading requirements but you must keep the cash in there for 60 days.

Here’s our full review of Moomoo.

💲Webull – up to 12 free stocks

Webull is a free trading app from Webull Financial. They are a brokerage based out of New York City and regulated by FINRA, you can look them up on BrokerCheck. We have a full review of Webull and their offer here.

For new signups, open an account and they will give you up to 12 free stocks. They have no fees and no account minimums so it’s truly free stock. We consider them one of the best Robinhood alternatives.

Here’s our full Webull review.

Get your free stock from Webull

Yieldstreet – up to $500

Yieldstreet isn’t a traditional brokerage account where you can trade securities like stocks and bonds, it’s an investment platform where you can invest in alternative investments that offer up cash flow. It’s similar to a brokerage (closer to a brokerage than a traditional bank, for example) in that it’s investment focused, which is why we included it on this list.

You can get a bonus based on how much you deposit into your account:

- Get $250 when you deposit $5,000 – $9,999.99

- Get $500 when you deposit $10,000+

Here’s our full review of review of Yieldstreet.

Get up to $500 from Yieldstreet

Firstrade – up to $5,000

Firstrade has a limited time promotion for the new year that you’ll want to take advantage of – you can get up to $5,000 for opening a new account. Firstrade is a brokerage based out of Flushing New York and they’ve been in business since 1985.

They offer commission free trades on all trades – stocks, options contracts, ETFs, mutual funds, bonds – plus no deposit minimums and no hidden fees.

To get it, just open an account, deposit at least $5,000 and you’ll get a cash bonus of $50. Increase your deposit or transfer amount and the bonus goes up.

Here is the full Firstrade bonus structure:

| Deposit or Transfer Funds | Cash Back Bonus Amount |

|---|---|

| $5,000 – $9,999 | $50 |

| $10,000 – $24,999 | $100 |

| $25,000 – $99,999 | $300 |

| $100,000 – $499,999 | $700 |

| $500,000 – $999,999 | $1,500 |

| $1,000,000 – $4,999,999 | $3,000 |

| $5,000,000+ | $5,000 |

Firstrade also offers free trades as well as ACAT fee reimbursement of up to $200 when you switch.

💲Robinhood – free stock (valued $5 - $200)

Robinhood is a no-commission fee brokerage that will give you free stock (valued $5 - $200) when you open an account and link a bank account. There are no other requirements of the offer, you just need to open an account.

No deposit (for the stock, you need to deposit for the cash), no transfer, no nothing.

Here’s our full review of Robinhood.

Get free stock (valued $5 - $200) from Robinhood

Here is also how Robinhood compares to Webull.

M1 Finance – up to $20,000 [EXPIRED]

M1 Finance is self-directed robo-advisor that facilitates investing by letting you invest in “pies,” or baskets of stocks. You can build your own pie or pick from one of several “Expert Pies” based on your risk tolerance and investment goals. The most surprising part is that it’s completely free, they make money through other financial products (interest on margin, transaction fees on their debit card) and sale of order flow (same as Robinhood and other free brokerages).

They have a new account bonus based on how much you deposit:

| Deposit Amount | Your Bonus |

|---|---|

| $100,000 – $249,999 | $250 |

| $250,000 – $499,999 | $1,000 |

| $500,000 – $999,999 | $2,000 |

| $1,000,000 – $1,999,999 | $4,000 |

| $2,000,000 – $4,999,999 | $10,000 |

| $5,000,000 – $6,999,999 | $15,000 |

| $7,000,000+ | $20,000 |

Here’s our full M1 Finance review.

TradeStation – up to $3,500

TradeStation has a new account bonus where you can get $150 in cash or $150 in Bitcoin.

To get $150 cash, open an account with the promotion code TSTVAFYB and then fund that account with $500 or more. Then maintain that balance to get the cash deposited in two $75 deposits. The first will be made at the end of the second full month and the second payment will be made at the end of the third full month.

To get $150 in Bitcoin, open an account with the promotion code TSTVAFYH and then deposit $500 worth of crypto (or purchase $500 worth of crypto). Then maintain that balance to receive two $75 worth of Bitcoin payments.

It’s very important you put in the right codes for whatever promotion you want.

There is also a transfer bonus of up to $3,500 when you transfer in at least $1 million. The bonus schedule does start at $5,000 in assets (lower than many on this list) so it’s not just for moneybags!

| Qualifying Assets | Cash Reward |

|---|---|

| $5,000 | $150 |

| $25,000 | $300 |

| $100,000 | $400 |

| $200,000 | $1,000 |

| $500,000 | $2,000 |

| $1,000,000 | $3,500 |

Acorns – $20

Acorns has an investment bonus of $20 when you:

- Set up a Acorns account

- Set up Recurring Investments

- Make your first successful Recurring Investment (min $5)

You will get your $20 within the 10 days of the following month.

Here’s our full review of Acorns.

Public – up to $30,150

Public has a transfer promotion where you can get a big bonus for transferring a lot of assets into your new account. They claim that they, are on average, 2X higher than competing offers.

The amount you get isn’t strictly based on the dollar amount of your assets. It’s based on the exact mix. To find out how much you’ll get, you can link up your accounts using Plaid and they will give you an exact dollar amount.

The bonus will depend on the mix of assets but this table should give you a basic idea of how much to expect:

| Amount | Bonus |

|---|---|

| Less than $5,000 | up to $175 |

| $5,000 – $24,999 | up to $300 |

| $25,000 – $99,999 | up to $750 |

| $100,000 – $249,999 | up to $1650 |

| $250,000 – $499,999 | up to $3150 |

| $500,000 – $999,999 | up to $6150 |

| $1,000,000 – $4,999,999 | up to $30150 |

If you don’t qualify for a custom bonus amount, they also offer this:

| Transfer Amount | Bonus |

|---|---|

| $5,000 – $24,999 | $150 |

| $25,000 – $99,999 | $250 |

| $100,000 – $249,999 | $600 |

| $250,000 – $499,999 | $1,000 |

| $500,000 – $999,999 | $2,000 |

| $1,000,000 – $4,999,999 | $4,000 |

| $5,000,000+ | $10,000 |

Also, one of the nice perks of Public and their ACAT transfer process is that they will also reimburse your fees on the transfer as long as you bring over at least $500.

Here’s our full Public review.

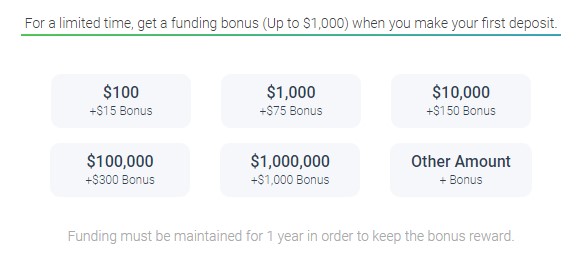

Tornado – up to $1,000

Tornado has a referral program where you can get up to $1,000 (but at least $10) when you sign up. The referring customer gets $10 to $1,000 too – and it’s a limited time offer.

The only requirement is that you make one trade within a month and you can keep the bonus, which you can withdraw after a year. There are no other requirements for the new account bonus.

There is also a deposit bonus. For a limited time, after you open your account, you can get a bonus based on what you deposit. You need to maintain this amount for one year to keep the deposit bonus.

Here’s our full Tornado review.

E*TRADE – up to $1,000

E*TRADE has offered a brokerage promotion for a long time.

For years, they had an offer where you could get up to $3,000 (if you had over a million dollars in assets to transfer!) and 60 days of free trades if you open a non-retirement brokerage account. The offer has been scaled back a little bit.

With the recent rush of brokerages offering free trades, the promotion is now just cash – remember to use the promotion code . For more, check out our E*Trade review.

| Deposit Amount | Bonus Amount |

|---|---|

| $1,000 – $24,999 | $100 |

| $25,000 – $49,999 | $150 |

| $50,000 – $99,999 | $200 |

| $100,000 – $199,999 | $300 |

| $200,000 – $499,999 | $600 |

| $500,000+ | $1,000 |

This is for new accounts but there is also an offer for existing accounts (it’s listed on the same page).

(Offer expires 2/29/2024)

SoFi Invest – $25

SoFi Invest is the brokerage arm of SoFi, the student loan refinancing company. They’ve recently branched out into other areas, including SoFi Money (banking), and they are now offering a $25 bonus if you sign up and deposit at least $100.

With SoFi Invest, you can manage your portfolio (Active Investing) or go with a roboadvisor approach (Auto Investing). With Active Investing, you can invest in stocks, cryptocurrencies, and ETFs without paying a trading commission.

For a limited time, get $50 in stock from SoFi Invest if you sign up with a referral link and deposit at least $100. There’s no trading requirement.

U.S. Bank Automated Investor – $100

U.S. Bank has a limited time offer where you can get $100 to open a new Automated Investor account before 12/31/2023. Then, within the first 30 days, transfer or deposit at least $1,000 in new cash or securities and keep that amount in the account for 120 days.

This is only available to existing U.S. Bank and U.S. Bankcorp clients and the account has an annual advisory fee of 0.24% of invested assets, billed quarterly.

Learn more about U.S. Bank Automated Investor

Citi Personal Wealth Management – up to $5,000

Citi Personal Wealth Management has a juicy bonus offer when you transfer New-to-Citi funds within 2 months of opening an account. You also will need to enroll in e-delivery of statements and then keep those funds in the account through the end of the next month (or three months after the month of account enrollment). Bonus will be credited three months after you meet the maintenance requirement.

Here’s the Citi bonus transfer schedule:

- Fund with $50,000 – $199,999 – $500

- Fund with $200,000 – $499,999 – $1,000

- Fund with $500,000 – $999,999 – $1,500

- Fund with $1,000,000 – $1,999,999 – $2,500

- Fund with $2,000,000 or more – $3,500

See the offer at Citi

(Offer expires 3/31/24)

Merrill Edge – up to $600

Merrill Edge, a Bank of America Company, will give you up to $600 if you open a new Merrill Edge account using the offer code 600ME. You just need to transfer your funds within 45 days, maintain that balance for 90 days, and you will get the cash bonus in 2 weeks. This bonus applies to individual Merrill Edge IRAs or Cash Management Accounts, which is what they call their taxable brokerage accounts.

Here’s the Merrill Edge bonus transfer schedule:

| Qualifying Assets | Cash Bonus |

|---|---|

| $20,000 – $49,999 | $100 |

| $50,000 – $99,999 | $150 |

| $100,000 – $199,999 | $250 |

| $200,000 or more | $600 |

Charles Schwab – Multiple Bonuses

Charles Schwab has three account promotional bonuses:

Charles Schwab $101 Starter Kit

Charles Schwab is offering new investors a “Schwab Starter Kit” that includes $101 in stock split up between the top five stocks (“slices”) in the S&P 500. You also get access to investing education and various tools and resources.

To get this, you need to open an account on the promotional page and then fund that account with at least $50 in 30 days. The stocks are “Schwab Stock Slices,” which are simply fractional shares of stock, and you get them on the next trading day.

At the time of this writing, the top five stocks at Amazon, Microsoft, Tesla, Alphabet (Google), and Apple.

See the offer at Charles Schwab

(No expiration shown)

Charles Schwab Investor Reward – Up to $2,500

This reward is available to existing and new accounts, you just need to enroll and, within 45 days, deposit at least $50,000. The bonus is based on your deposit amount:

| Make a qualifying net deposit of cash or securities into an eligible account: | Bonus: |

|---|---|

| $50,000 – $99,999 | $200 |

| $100,000 – $249,999 | $300 |

| $250,000 – $499,999 | $600 |

| $500,000 – $999,999 | $1,200 |

| $1,000,000+ | $2,500 |

If you are an existing client, you’ll have to call 800-503-3307 to enroll.

Charles Schwab Refer a Friend – Up to $1,000

Charles Schwab also has a refer a friend bonus when you open up a new account with a referral link (here) and transfer in funds of at least $25,000 within 45 days. The bonus is based on how much you deposit, which follows this schedule:

- Fund with $25,000 – $49,999 – $100

- Fund with $50,000 – $99,999 – $300

- Fund with $100,000 – $499,999 – $500

- Fund with $500,000 or more – $1,000

👉 Open a new account with this Refer a Friend link

Fidelity Account – $100 Cash

Fidelity has a new promotion where you can get $100 for opening a Fidelity Account, Cash Management Account, Roth or Traditional IRA. All you have to do is deposit $50 or more within 15 days and you’ll get the $100 within 25 days of opening your account.

The promo code is FIDELITY100 and the offer has no shown expiration date. It is limited to one offer per customer and US residents.

What’s important to note is that existing customers are eligible as long as you open an eligible account and meet the requirements. Finally, you must keep the $100 cash reward in the account for a minimum of 90 days.

Frequently Asked Questions

Here are some frequently asked questions about bonuses and the brokerage transfer process.

Almost every brokerage firm supports ACATS, which stands for Automated Customer Account Transfer Service, which lets you transfer your assets “in-kind.” This means that your holdings are transferred without you having to sell them (and create a taxable event). If you have big unrealized gains in a stock, the shares just get moved over without you having to sell them and you keep the same cost basis.

You may run into hiccups if some items can’t be transferred. One common example is Vanguard Admiral shares of their mutual funds. Some brokerages will take them, others won’t. In these cases, you may have to transfer them to another asset type (like the ETF version), which will accept them.

ACATS does take a week or two to complete the transfer.

I don’t think it’s worth switching from broker to broker, grabbing up the bonuses, but the process isn’t difficult.

If you’re looking to make a move anyway, getting paid a little for the effort is better than not being paid.

Some brokers may charge you to leave, which is something you’d be paying anyway, so hopping around may reduce your returns from the bonus perspective.

If you are creating new taxable brokerage accounts, the bonuses will be reported as income and you will have to claim them on your taxes as income.

If you are creating retirement accounts, like an IRA, the bonuses are going into those accounts so you won’t owe taxes on them immediately. For traditional IRAs, you’ll just be taxed when you start taking distributions. Roth IRAs will never be taxed. For each account, review the terms and conditions to see how the brokerage is treating it and you’ll know for certain.

Evan says

Jim, the Schwab bonus is a targeted offer for Stock Plan Participants, a very narrow group of clients, it is not available for the public. The fine print has more info. You may want to edit the info on your post. The only cash incentive is a $100 bonus via referral from a friend using their unique code.

You make a great point – I missed that Stock Plan Participants was a narrower group, thanks!

Wilson says

What is a “Stock Plan Participant” and how does one qualify for that?

It typically means you are part of a corporate stock plan.

Peter says

Great point. Its so misleading…….

Bob says

I see your update was June5th 2019 and you stated E*TRADE had no offer. Did this just become available? I just searched this

account will be credited within one week of the close of the 60-day window, as follows:

Receive

Deposit or Transfer

$2,500 + commission-free trades

$1,000,000+

$1,200 + commission-free trades

$500,000–$999,999

$600 + commission-free trades

$250,000–$499,999

$300 + commission-free trades

$100,000–$249,999

$200 + commission-free trades

$25,000–$99,999

Only commission-free trades

$10,000–$24,999

Yes it looks like it just came back, thanks Bob!

frank sparacino says

I stumbled onto your site looking for brokerage promotions.

I wanted to thank u for the good info.

I’m gonna try JPM/YOU INVEST. $625 cash, 100 free trades, THEN JUST $2.95 A TRADE. I confirmed via phone just now.

TDA bought out Scottrade acct. AND OFFERED US ZIP! Yet, look at what they r giving “new clients” (+ i’m not wild about TDA platform).

fingers crossed, no small print funny bizness!

$625 never hurts!

Khoa says

Regarding TD Ameritrade’s “refer a friend” promotion, if I had an individual brokerage account at TD Ameritrade but closed it three years ago, would I be eligible for any bonus in this promotion if I signed up for a new one today?

I don’t know but if you are ineligible, TD Ameritrade won’t let me send you a referral. It’ll say “undeliverable.”

Jon says

The Merrill Edge promotion says, “respond by September 5, 2019” and I tried to apply using the promotion code, and verified that it’s expired 🙁

Sadly, you are correct that the $1,000 version of this offer has expired. Thank you for letting me know, I’ve updated it with the new offer (same code of 600ME) but with a lower bonus.

bill sievers says

I have funds in 2 brokerage accounts, (WeiisFargo & Stifel), approximately $150K, what is best move to minimize closing fees and/or maximize promotion incentives? Thanks Bill S

Hi Bill – with $150,000, you could get $500 from TDAmeritrade and that’s the highest cash offer. Depending on how much Wells Fargo and Stifel charge you for an ACAT transfer (that’s asset-to-asset transfer, so you don’t have to sell your holdings), you may save more with Ally Invest and their lower bonus ($300) because they will refund you up to $150 in fees. I still think TDAmeritrade is going to be better with the cash bonus.

Mike Hardiman says

Dude, you’re a rock star!! You just made me $375 from Merrill Lynch. Those S.O.B.s I opened an account over the phone and they didn’t tell me about the bonus and I’m a Platinum customer for ten years or something. So I closed it and opened one myself online and now will get the $375 – which is the $250 bonus you have listed above, plus 50% on top if you are a Platinum.

That’s awesome! Congratulations! You should sign up to the newsletter! 🙂

Joshua Foster says

Does anyone know if TD Ameritrade charges asset transfer fees? Thinking of transferring Roth IRA assets into TD & Traditional IRA assets into Ally from Vanguard. Do both IRAs have to be at the same brokerage? Maybe split up non retirement assets in chase & e trade.

Typically a brokerage charges fees to do an ACAT (transfer) OUT of their brokerage. They don’t charge anything to transfer INTO an account.

Steve says

E*TRADE https://us.etrade.com/what-we-offer/how-it-works/brokerage says “You must be original recipient…”. I checked with them, bonus is only available to those receiving offer directly from E*TRADE

Mikael says

Although you touch on it briefly, a major factor in transferring accounts is which mutual funds and ETFs can be held by the new firm. This is vital because if they aren’t setup to hold that fund, it will get sold as part of the ACAT transfer. Which could have HUGE ramifications as far as the timing, the resulting capital gains/losses, tax implications, etc. Personally, I have found it a nightmare trying to simply find comprehensive lists of what funds the various firms above can/can’t hold. If you have any direct links to such lists that would be a major benefit to anyone visiting this page and considering an account transfer. Thanks!

Robert says

Call me stupid, but I can’t figure out how to send a referral request to you at this address: moc.skcahtellaw@edartiremadtj+mij. Can you please translate for me? My email program rejects this address.

It’s my email reversed but it’s supposed to flip it visually on the screen using CSS – it’s just my name (Jim) at wallethacks dot com.

Tommy Waddle says

Citi has a better offer for those$200,000 https://banking.citi.com/cbol/investment/cpwm/default.htm?BT_TX=1&ProspectID=9C7D7FA733D54785B24D99D48C2932F1

Thanks Tommy!

David J Kaarby says

I have over $750 k with Etrade, what broker do you recommend that is better then Etrade?

I’ve listed all the promotions I’m aware of and it sounds like Ally Invest may be a good option given the large balance.

Marco says

Hi Jim. You might think about removing YieldStreet from your list of recommendations. I attempted to open an account and transfer $10,000 in order to participate in the $500 promotion on 07/07/21. Their system said the funds would clear on 07/15/2021. However, the deposit never occurred. They don’t answer their customer service phone number giving some generic message that due to Covid19 they ask to email them instead and then they don’t respond to the email either. I emailed them 7 days ago and have yet to get a response. They have this feature that you can schedule a 15 minute call with an advisor assigned to your account, but the earliest appointment that can be scheduled is several days into the future. This is not how a financially responsible institution handles their business. This prompted me to further investigate the company and I was alarmed to discover that they have several class action lawsuits against them for not properly vetting their borrowers and their investors are losing all of their investment. Their rate of default is much worse than what they publish. In fact, you have LESS risk investing in JUNK bonds than you do with their investment vehicles. Learn from my experience and RUN away from this one.

This is concerning Marco, where did you find the lawsuits?

Gary Grewal says

I always say, bank and brokerage account bonuses are easy ways for a DIY stimulus check for those of us that didn’t make the cut! Thanks for always updating so thoroughly Jim .

You’re very welcome! I think they’re a great way to put a little extra cash in your pocket!

Wendy says

Good morning.

Please let me know if TradeStation is a legitimate company, how does it compare with Schwab and Fidelity?

They’re legit, they were founded in 1982 and regulated by the SEC and FINRA. Their parent company is Monex Group.