Buy now, pay later services allow you to make expensive purchases with low monthly payments. Zebit offers spending limits as high as $2,500 and the ability to pay for goods for six months interest-free.

No credit check is required to shop in this online marketplace featuring over 175,000 products. In this Zebit review, I let you know what to expect before you start shopping and if Zebit is the best place to find great buy now, pay later deals online.

(this is different than a service like Affirm, which offers BNPL services to various merchants)

Table of Contents

What Is Zebit?

Zebit is an online marketplace specializing in buy now pay later (BNPL) payment plans. Shoppers can receive items after making an initial payment and pay off the remaining balance over the next six months.

You don’t need a credit card or a minimum credit score to qualify for a Zebit account. Instead, the platform verifies your income history to determine your shopping limit (up to $2,500).

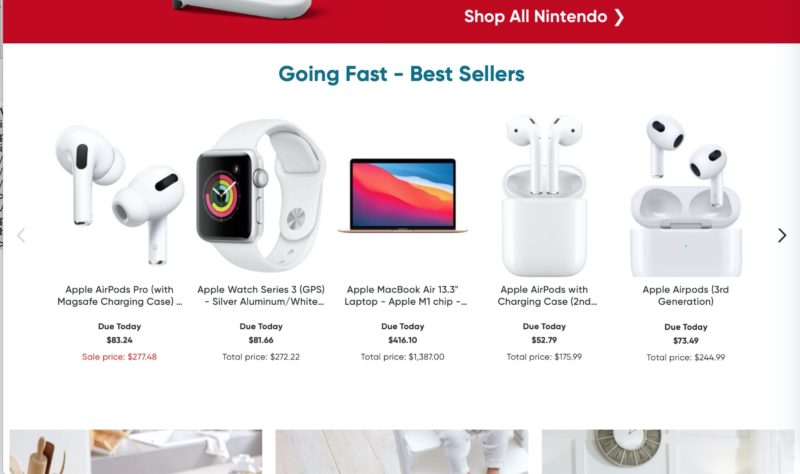

Next, you can start shopping for items from many product categories, including:

- Beauty

- Electronics

- Fashion

- Fitness

- Food

- Furniture

- Gift cards

- Home and decor

- Kitchen.

It’s free to shop, and you only pay fees when you purchase.

BNPL services are one of the most popular shopping services and are the digital equivalent of layaway plans that brick-and-mortar retailers like Walmart, Kmart, and others used to offer. They can help you buy expensive items with small payments, but your total fees can be higher than just buying the product by paying the whole amount upfront if you have the cash.

Who Can Use Zebit?

You must be at least 18 years old and live in the United States to shop with Zebit. In addition, a steady income is necessary to qualify for a higher shopping limit.

You may consider shopping at Zebit if you need to make a large purchase greater than $100 but don’t have enough funds to pay for the entire transaction upfront.

Unfortunately, Zebit currently isn’t available in Washington, D.C.

How Does Zebit Work?

It’s free to join Zebit and shop, and you only pay when you’re ready to buy something. Here is a step-by-step look at how the shopping process works.

Qualify for a Zebit Line

The first step is creating an account and qualifying for a Zebit Line spending limit. The maximum limit is $2,500, but your line amount will likely be lower. The average limit is between $1,000 and $2,500, according to Zebit.

For example, if your Zebit limit is $1,000, you can buy up to $1k in goods. You must pay off your existing balance to restore your limit to its maximum amount.

This platform can be an excellent alternative to a no credit check loan as you can have a more flexible repayment term and potentially lower fees.

Zebit analyzes your annual income and performs a soft credit check to determine your spending limit. This soft credit inquiry won’t hurt your credit score.

Before making a purchase, Zebit may also perform another soft credit check to verify that your financial conditions haven’t changed before processing your order.

Make a Purchase

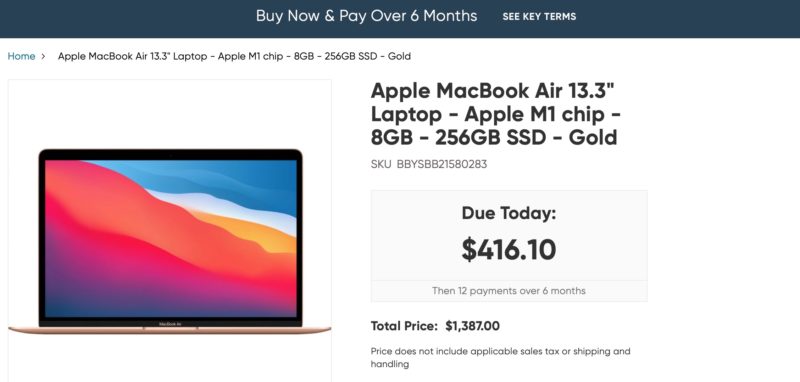

You can buy one or multiple items from the diverse product catalog. In addition, the service lists your total price and repayment options.

One benefit of using Zebit is its transparent pricing. You can see your minimum down payment and total purchase price (includes item cost, sales tax, and shipping & handling).

As a result, it’s also easier to predict your total out-of-pocket expenses versus payment programs or credit cards that charge interest. Your entire costs can depend on how long you carry a balance with these programs.

However, the product prices are noticeably higher than other online shopping sites. Always compare prices with at least one or two different stores.

Here are some of the pricing comparisons for select items (excludes taxes and shipping):

| Item | Zebit Price | Competitor Price |

| Apple MacBook Air 13.3”- 8GB | $1,387.00 | $999.99 (Best Buy) |

| Nintendo Switch — OLED model with White Joy-Con | $499.99 | $349.99 (Target) |

| Gucci GG Marmont Small Matelasse Shoulder Bag (Model #447632) | $1,604.84 | $1,550.00 (Gucci) |

*These price quotes are from April 4, 2022. They don’t include shipping fees or sales tax, widening the gap even more.

Zebit is usually more expensive as they buy items at wholesale price and charge a premium to make a profit and offset potential losses when shoppers don’t complete every payment. The higher prices can be one downside of no credit check.

Shipping Speeds

You can expect to receive your items within 7-10 business days after making your initial payment. Digital eCertificates (digital gift cards) deliver within 4-8 hours.

If your order contains multiple items, you may receive several shipments as each product supplier may use a different warehouse.

Repayment Period

After the shopping site approves your order, your item ships after making the initial down payment with a credit card or debit card. Your upfront charge is approximately 25% of the total purchase price.

You will make biweekly, weekly, or monthly payments for the next six months. The payment schedule can vary by item and your income history. After paying for the entire purchase, your spending limit returns to its usual amount.

It’s also possible to pay the whole amount upfront. However, as the Zebit selling price can be higher than other retailers, you may use a cashback site to find the lowest price.

If you don’t complete every payment, you can keep the item but may not be able to make future purchases on the marketplace.

Refund Policy

All sales are final, and you cannot request a refund or exchange an item if you experience buyer’s remorse or the product doesn’t meet your expectations.

It is possible to request a refund or replacement for damaged items. You must notify Zebit within ten days of receiving your product to file a claim in these situations.

Zebit Fees

There are no membership fees like you’ll find in a warehouse club. You also won’t pay interest charges.

Unavoidable Fees

There are two fees that you will encounter on every order:

- Shipping and handling (free shipping for home, auto, and kitchen products)

- Sales tax

In place of shipping charges, eCertificates incur an 18% handling fee.

You won’t see these costs until visiting the checkout screen. While shopping, you only see the total purchase price, which is the final amount you pay after six months of payments.

Extended Warranty

You may also have the option of buying an extended warranty for your physical products. This cost depends on the product value and warranty duration.

Best Zebit Features

Zebit has several unique features to appeal to members. You can browse more than 175,000 items in the Zebit Market and enjoy high spending limits and flexible repayments. Let’s take a closer look at many features Zebit has to offer.

Zebit Market

The Zebit Market is an online shopping place with over 175,000 products in these categories:

- Appliances: Small and large household appliances

- Auto: Electronics, tools, and tires

- Beauty: Bath, fragrances, hair care, makeup, skincare

- Clothing: Men’s, women’s, children’s, footwear, handbags, sunglasses

- Electronics: Apple, Samsung, audio, cell phones, certified refurbished, drones, etc.

- Furniture: Accent furniture, bedroom, kids, mattresses, outdoor furniture, etc.

- Grocery: Groceries by Boxed, Food Service Direct (FSD), beverages, meat, seafood, baby items, personal care, etc.

- Home: Bed & bath, Cleaning & laundry, home décor, home improvement, travel luggage

- Jewelry: Bracelets, earrings, necklaces, rings, wedding and engagement rings

- Kitching and Dining: Bakeware, cookware, cutlery, grills

- Sports and Rec: Biking, camping, fitness equipment, fitness trackers, golf, etc.

- Toys: Action figures, crafts, dolls, learning toys, musical instruments, scooters

Each item has a product description, down payment, monthly payment amount, and total purchase price.

eCertificates

You can purchase digital gift cards for your favorite restaurant, retail, and travel brands – a good option if you want to give one to a friend or family member.

Because of the 18% handling fee, consider buying these cards somewhere else when possible. For example, you might get bonus fuel points if you buy them from a supermarket to save money on gas.

Up to $2,500 Spending Limit

You can qualify for a shopping limit worth up to $2,500 after a soft credit check and verifying your income.

Not undergoing a credit check to enroll in a monthly payment plan can make this service more appealing than other platforms.

Your initial Zebit Spending Limit is likely lower than the $2,500 maximum. However, you can qualify for an increase every 3-6 months with consistent payments.

Flexible Repayments

Your down payment is 25% of your total purchase price, and you repay the remaining balance over the next six months.

The service strives to time the payment due dates with your paydays.

Your payment frequencies can be one of the following:

- Weekly

- Biweekly

- Semi-monthly

- Monthly

Frequent repayments may be necessary for the most expensive products.

No Credit Check

This platform is ideal if you have bad credit or no credit history and struggle to qualify for traditional financing. Your income secures your purchasing power instead of your FICO Score.

Missing a payment won’t hurt your credit as a loan or credit card payment can. But unfortunately, your payment history won’t report to the credit bureaus, which isn’t positive if you’re hoping to build credit to eventually qualify for lower fees and interest rates.

Zebit Mobile App

The Zebit mobile app is available for use on Android and iOS devices. This fully functional app lets you shop the online market, make purchases, and track orders.

Zebit Pros and Cons

Pros

- No hidden fees or interest charges

- No credit check required

- Over 175,000 products for sale

- 6-month payment plans

Cons

- High prices

- Shipping fees on most purchases

- Won’t improve your credit score

- No returns or exchanges

Zebit Alternatives

Before signing up with Zebit, I recommend checking out similar sites to ensure Zebit is the right one for you. Below are a few Zebit alternatives that offer unique features and competitive prices.

Decluttr

You can use Decluttr to purchase refurbished electronics like smartphones, tablets, fitness trackers, videogame systems, and movies. While your desired device may not be brand-new, it can be a fraction of the retail price and provide several years of use.

Shipping can be free, and a 12-month limited warranty may apply.

Decluttr partners with the BNPL service Klarna if you need to make affordable monthly payments.

Tip: You can also sell your old electronics, movies, and books with Decluttr to make money fast.

Swappa

Swappa lets you buy phones, tablets, cameras, watches, and video games at competitive prices. In addition, next-day delivery is available in 48 metro areas through the Swappa Local program.

Perpay

Perpay offers similar products and repayment options to Zebit. Joining doesn’t require a credit check to qualify for a spending limit.

One difference between Perpay and Zebit is that Perpay reports your on-time payments to the major credit bureaus. As a result, you can start seeing a credit score increase after four months, according to the platform.

Raise

If you want to use Zebit for buying gift cards, consider Raise instead. You won’t pay any service fees, and it’s also possible to purchase them at a discount of up to 30% below their face value.

Most gift cards are digital and delivered within a few minutes, but physical cards ship in the mail. Each card also has a one-year guarantee to protect against incorrect balances or a deactivated card.

Zebit FAQs

You can only shop in the online Zebit Market through the retailer’s website or mobile app. Your Zebit Spending Limit is similar to a store charge card and doesn’t work at other online stores. Thankfully, you can buy many household, fashion, and technology items from popular brands.

No, Zebit won’t report your payment history to the major credit bureaus. The platform also doesn’t perform a hard credit check to determine your creditworthiness and won’t hurt your credit either.

Shoppers can upload a paystub or verify their bank account balance to verify their income history and payment frequencies.

Zebit protects your personal information from data thieves with standard industry practices. This retailer can also prevent scams as they partner with reputable, well-known retailers to provide products.

You also won’t encounter hidden fees or interest, as you can preview your total purchase amount and repayment schedule before making your first payment.

If you encounter problems, you can receive email support by submitting a request online or through the Zebit app from your account dashboard.

Zebit makes money by buying items at wholesale prices and selling them for a higher price. This online retailer doesn’t charge membership fees, interest, or late fees.

The Bottom Line on Zebit

Zebit can be a cheaper option than other buy now pay later and rent-to-own services selling electronics, fashion items, and home goods on your shopping list. Dealing with Zebit won’t affect your credit score, which can be good or bad depending on your credit goals.

While this site makes it convenient to buy expensive items, the high prices and easy repayment plans can make it easy to overspend. So before hitting the “buy” button, consider your spending limit and compare prices to get the items you need without hurting your wallet.