The Oxford Communiqué

Product Name: The Oxford Communiqué

Product Description: The The Oxford Communiqué is the flagship paid newsletter of The Oxford Club. It's written by Alexander Green, a 20 year Wall Street veteran, and is a monthly newsletter that includes his thoughts on the market and his latest investment ideas. Each newsletter includes on growth-focused idea, model portfolios, but spans a variety of industries.

Summary

The Oxford Communiqué is one of several newsletter and trading services published by The Oxford Club. The Oxford Club describes itself as a “private, international network of trustworthy and knowledgeable investors and entrepreneurs” and boasts that it has 159,000 members in 130 countries. It publishes several newsletters such as The Oxford Club and The Oxford Income Letter.

Overall

Pros

Multiple model portfolios

Affordable pricing

Frequent portfolio updates and investor communications

Has been around for over 30 years

365-day refund guarantee

Cons

Not suitable for short-term fixed-income investors

Stock picks are not guaranteed to make money

You will receive marketing emails

The Oxford Communiqué is a budget-priced investing newsletter that costs as little as $49 per year. At approximately half the cost of competing products, The Oxford Communiqué is an affordable way to access multiple model portfolios with different risk tolerances.

Casual stock pickers and those with other newsletter subscriptions can benefit from this service, too. However, before you subscribe, it’s worth asking if joining the Oxford Club is worth it.

As an active subscriber, I share my insights about the member perks and how to get the most from your membership in this Oxford Communiqué review.

Table of Contents

- What Is The Oxford Communiqué?

- Oxford Communiqué Pricing

- Oxford Communiqué Key Features

- Is Oxford Communiqué Legit?

- Who Should Join Oxford Communiqué?

- Oxford Communiqué Pros and Cons

- Alternatives to Oxford Communiqué

- FAQs

- How much does the Oxford Club cost?

- Do Oxford Communiqué stock picks make money?

- How many members does the Oxford Club have?

- Final Thoughts

What Is The Oxford Communiqué?

The Oxford Communiqué is the flagship stock newsletter of The Oxford Club. It presents readers with at least one growth-focused investing idea each month. As this is an entry-level product, the stock picks appeal to a broad swath of investors with ideas covering a variety of industries such as biotech, financials, and industrials.

The newsletter also includes several model portfolios you can use to help build a diversified portfolio of funds. These additional resources can prevent your asset allocation from concentrating too much on company stocks and get exposure to more asset classes.

The target holding period is at least a year for most stock recommendations, though many companies have been portfolio staples for over 20 years. To guard against market volatility and portfolio losses, the newsletter uses stop losses to issue a sell alert when a stock trades below a specific price.

The Oxford Club has been helping individual investors get exclusive access to stock picks for over 30 years. Despite its elite-sounding name, The Oxford Club comprises over 159,000 individual investors worldwide. Its affordable pricing helps regular investors access ideas exclusive to cocktail parties and professional investors just a few decades ago.

The Communiqué’s senior editor is Alexander Green, an experienced Wall Street portfolio manager and analyst. His stock expertise crosses many industries, including highly aggressive biotech stocks to more conservative income-focused assets.

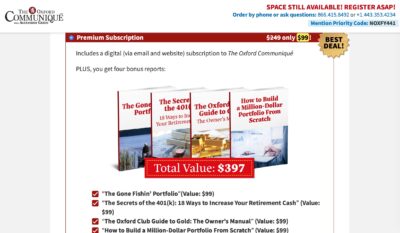

Oxford Communiqué Pricing

An annual subscription to The Oxford Communiqué starts at $49 per year. There are three different subscription tiers:

- Basic Subscription ($49 for the first year and then $79): A digital-only subscription to the Communiqué.

- Deluxe Subscription ($129 per year): An email and online subscription.

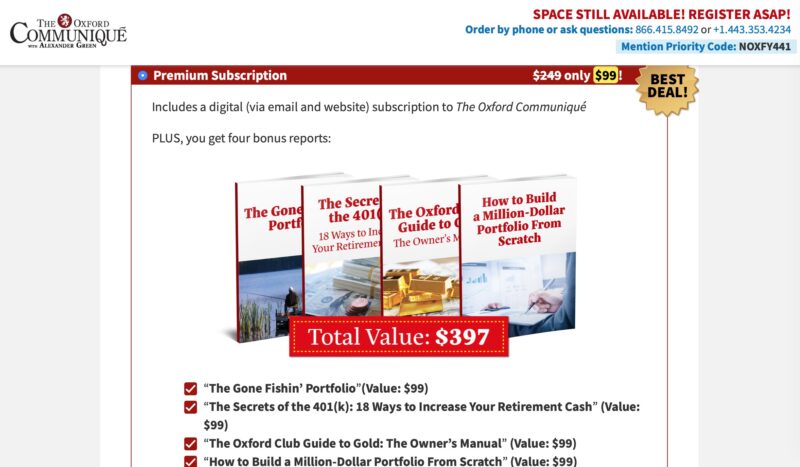

- Premium Subscription ($99 per year): A digital subscription plus access to four bonus reports (Gone Fishin’ Portfolio, Secrets of the 401(k), Oxford Club Guide to Gold, How to Build a Million-Dollar Portfolio from Scratch”).

These numerous pricing tiers can be frustrating, but I recommend the Basic or Premium tiers for most subscribers. Both are affordable, considering many similar publications cost over $200.

365-Day Satisfaction Guarantee

The Oxford Club offers a 365-day full refund guarantee if the product doesn’t meet your expectations. This is one of the most generous refund periods in the industry, as many entry-level stock newsletters have a maximum 30-day satisfaction guarantee.

You can cancel your subscription by contacting customer service by phone or email.

Oxford Communiqué Key Features

Let’s look at what you can expect to receive after signing up for The Oxford Communiqué.

Monthly Stock Pick

Subscribers receive one stock pick when each new issue is released in the middle of each month. The recommendations are for highly liquid companies that you have likely heard of before.

The monthly issue provides a write-up about the company, its unique advantages, and action steps regarding the buy-up-to-price and trailing stop amount (typically 25%).

The monthly issue also updates other active recommendations with noteworthy movements or events. There are also tips to improve your quality of life outside of investing.

The newsletter releases weekly portfolio updates as the stock market can move quickly. These updates can also include hold and sell alerts that can’t wait until the next monthly release. However, depending on how many positions you invest in, keeping up with the news of each holding is time-consuming if you have limited free time.

While many suggestions can make money, I still recommend using stock research websites to research each portfolio holding to understand the risks and rewards. Additionally, due diligence helps you decide if a stock is a good fit for your strategy and portfolio.

Model Portfolios

Most stock-picking newsletters only offer a single trading portfolio with one monthly pick. I particularly enjoy the Oxford Communiqué since it has five model portfolios:

- Trading Portfolio: This cornerstone portfolio contains most of the new monthly stock suggestions. Its goal is to beat the stock market with diversified assets. This portfolio has the shortest investment horizon and places a “hold” recommendation when a position gets to within 5% of triggering its stop loss.

- Ten-Baggers of Tomorrow Portfolio: Speculative stocks with the potential to rise ten times (1000%) or more from the recommended price. You won’t get recommendations for high-risk penny stocks that typically trade for $5 or less and tend to be part of “pump-and-dump” marketing schemes.

- Oxford All-Star Portfolio: Basket of funds and holding companies managed by some of the world’s best money managers. Warren Buffett’s Berkshire Hathaway and Markel Corp. are two holdings, for example.

- Gone Fishin’ Portfolio: A long-term stock and bond index fund portfolio designed to preserve wealth and earn dividends. Its conservative asset allocation is based on Modern Portfolio Theory (MPT), which most robo-advisors use as their investment philosophy.

- Fortress Portfolio: This risk protection portfolio launched in July 2022 and also has a conservative risk tolerance. Some of the funds include a physical gold fund, inflation-protected securities, utility ETFs, and healthcare ETFs.

These portfolios provide exposure to many sectors and risk tolerances. Modeling several of these suggestions can make it easier to outperform the broad market with high-quality stocks, which is the primary goal of using stock newsletters instead of only index funds.

The Trading Portfolio is the most balanced but also requires the most maintenance. In May 2023, most holdings are from mid-2022 or more recent so that you can anticipate an investment period of one year or shorter.

The other portfolios can help you diversify your portfolio by offering exposure to conservative and aggressive strategies to help outperform the market. These models also require less rebalancing as you usually invest in mutual funds or ETFs that invest in multiple assets maintained by a fund manager.

Pillars of Wealth

In addition to investing in the latest stock picks or adding previous recommendations to your portfolio, you can review the Oxford Club Four Pillars of Wealth, which helps explain Oxford’s methodology.

The Pillars of Wealth are:

- Stick to the Oxford Wealth Pyramid

- Know your exit strategy

- Understand position sizing

- Cut investment expenses

These investing pillars assist with building a diversified portfolio and practicing risk management.

Special Reports

Most investment newsletters publish special reports that provide bonus stock ideas that may not be part of the model portfolio as it’s a cyclical trade.

Other times, these reports serve as a teaser to attract new subscribers and provide a more in-depth review of the company than the standard monthly report.

Some of the recent report titles include:

- 900-Pound Gorilla Dominating Gene Sequencing

- Capture Massive Profits in AI Medicine

- Future of Food: The Vertical Farm Supplier Feeding the World

- New King of LNG

- The 10% CD

- The Company Making a Fortune Solving the Food Crisis

- Three Best High-Yield, Low-Risk Investments Outside of Stocks

These captivating titles highlight companies and income-producing assets that can produce wealth without excess risk. Some reports also highlight companies to avoid due to their risky financials or unprofitable business practices.

Member-Only Events

High net worth subscribers can participate in exclusive trips and seminars that let you relax, sightsee, and interact with other investors. More than a generic cruise or vacation package, these getaways are accompanied by a newsletter editor. Guest speakers and complimentary meals are also part of the experience.

One example is the Investment U Conference, which features Oxford Club analysts as guest speakers. They provide additional insights that don’t appear in the monthly issues. Also available are a financial expedition in Ireland or a private wealth seminar in Lake Tahoe.

Is Oxford Communiqué Legit?

The Oxford Communiqué is a legit stock investment newsletter with positive customer reviews and a multitude of long-term subscribers. It’s affordably priced and can help you find successful stocks more consistently.

With that being said, not every stock recommendation will be profitable. Like any stock picking service, recommendations are more likely to hit their stop price during a bear market or volatile trading months.

Buying multiple recommendations increases the probability of earning a profit. As a new subscriber, taking the time to research back issues can help you see the successful and unsuccessful trades.

Who Should Join Oxford Communiqué?

The newsletter is ideal for investors who want affordable access to expert stock picks for a variety of industries. As an entry-level newsletter, most investors will find the recommended stocks easy to acquire and not excessively volatile.

Oxford Communiqué Pros and Cons

Pros

- Multiple model portfolios (near-term strategies and long-term holdings)

- Affordable pricing (as low as $49 yearly)

- Frequent portfolio updates and investor communications

- Continuously published for over 30 years.

- 365-day refund guarantee

Cons

- Not suitable for fixed-income investors

- Not every stock pick makes money

- Will receive marketing emails

Alternatives to Oxford Communiqué

Many investors choose to pair their Oxford Communiqué subscription with other free and paid investment publications to get even more investment ideas. With that in mind, here are some Oxford Communiqué alternatives to consider.

Morningstar Investor

Similar to Oxford Communique, Morningstar Investor lets you find out more about stocks and mutual funds with in-depth research reports.

Morningstar Investor makes the research process easier with its customizable stock screener, exclusive Morningstar ratings, and independent market analysis. It also has a built-in portfolio tracker to review your asset allocation and long-term performance.

Read our Morningstar Investor review for more.

Learn More About Morningstar Investor

Motley Fool Stock Advisor

The Motley Fool Stock Advisor provides two monthly stock picks from various industries. The investment team chooses stocks that have the potential to outperform the market over the next three to five years and doesn’t use stop losses.

Long-term investors are the best fit for this newsletter as it doesn’t use stop losses. As a result, you should be comfortable holding your stocks for an extended period through market downturns. An annual subscription is discounted for the first year ($99) and then costs $199 per year for each renewal. Read our Motley Fool Stock Advisor review to learn more.

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

Learn More About Stock Advisor

Seeking Alpha

Seeking Alpha is best suited for self-directed investors who want investment ideas from multiple sources. Instead of relying extensively on a model portfolio, you can read bullish and bearish commentary on most publicly-traded stocks and funds.

This platform also has a stock screener and a proprietary Quant Ratings system that makes finding and comparing potential investments more efficient.

There is a free and premium edition of Seeking Alpha. A paid membership is necessary if you plan on researching several stocks per month or want portfolio-tracking capabilities. Our Seeking Alpha review analyzes the stock comparison tools.

💵 Seeking Alpha Premium Spring Sale – 25% Off

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you. If it is, the regular price is $239 for an entire year and now you can get 25% off – making it just $179 for the year.

If you don’t like it, you can always downgrade to the Basic plan and still use all the portfolios, screeners, and research you’ve done without paying the premium fee.

The trial is a great way to test-drive Seeking Alpha Premium.

👉 Get the Seeking Alpha Premium 7-Day Free Trial

(Offer expires April 3rd, 2024)

Learn More About Seeking Alpha

Stansberry Research

Stansberry Research offers a variety of entry-level and specialty monthly newsletters that focus on dividends, deep value, options trading, and precious metals, to name a few strategies.

Stansberry’s Investment Advisory is the platform’s flagship publication and the most similar competitor to Oxford Communiqué. You receive a monthly stock pick, the annual subscription costs $199, and there is a 30-day satisfaction guarantee. Learn more about Stansberry Research in our full review.

Learn More About Stansberry Research

FAQs

How much does the Oxford Club cost?

It costs $49 to $99 per year for the Oxford Communiqué. A paid subscription includes a new stock recommendation every month, access to several model portfolios, and the ability to read back issues and weekly updates.

Do Oxford Communiqué stock picks make money?

Yes, but not every pick is profitable, as no professional investor has a 100% success rate. The track record varies by year, and the newsletter doesn’t publish its annual performance for most portfolios, but readers can track the closed positions for profitable and unsuccessful trades.

How many members does the Oxford Club have?

The Oxford Club, which is headquartered in Baltimore, Maryland, has more than 159,000 members across 130 different countries.

Learn More About The Oxford Communiqué

Final Thoughts

If you’re a long-term investor and have never subscribed to an investment newsletter, The Oxford Communiqué is one of the most affordable newsletters containing actionable investment ideas. Oxford’s analysts select an array of stocks and funds that can help diversify your portfolio but also earn gains from companies that have the best growth potential under current market conditions.

The price is affordable at $49 a year, and the 365-day money-back guarantee offers peace of mind. I don’t recommend the Oxford Communiqué if you are a fixed-income investor since stock picking won’t be a primary focus. Also, you may not receive full value for your money if you’re a passive index investor and prefer a hands-off approach to investing.